April 2024 Issue:

Die Heimatvertriebene: PART II

The Ethnic Cleansing of German Minorities after the War

This Months Articles:

This all needed a large labor force and waves of immigrants responded. Initially, the workers were mostly German and Irish. But the new arrivals found the stockyard’s working conditions horrid. Attempts were made to organize the laborers. On May 1, 1886, workers at the stockyards joined a nationwide strike for an eight-hour workday…

The change from semitic vengeance to social engineering as the basis for America’s policy during the immediate post war period got imposed on the German people by John J. McCloy, who would also impose social engineering in the form of ethnic cleansing on Catholic ethnic neighborhoods in the United States during the period immediately following his tenure as High Commissioner in Germany. As head of the Ford Foundation in the 1960s, McCloy would employ Black ministers like Leon Sullivan to recruit Black sharecroppers from North and South Carolina to drive Catholics out of ethnic neighborhoods in Philadelphia…

Latest Issues:

Why Hawthorne was Melancholy: Part II, The “Lost Clew” Explained

Restoring Iran’s Vision: Sexuality,

Women, and the Logos Incarnate

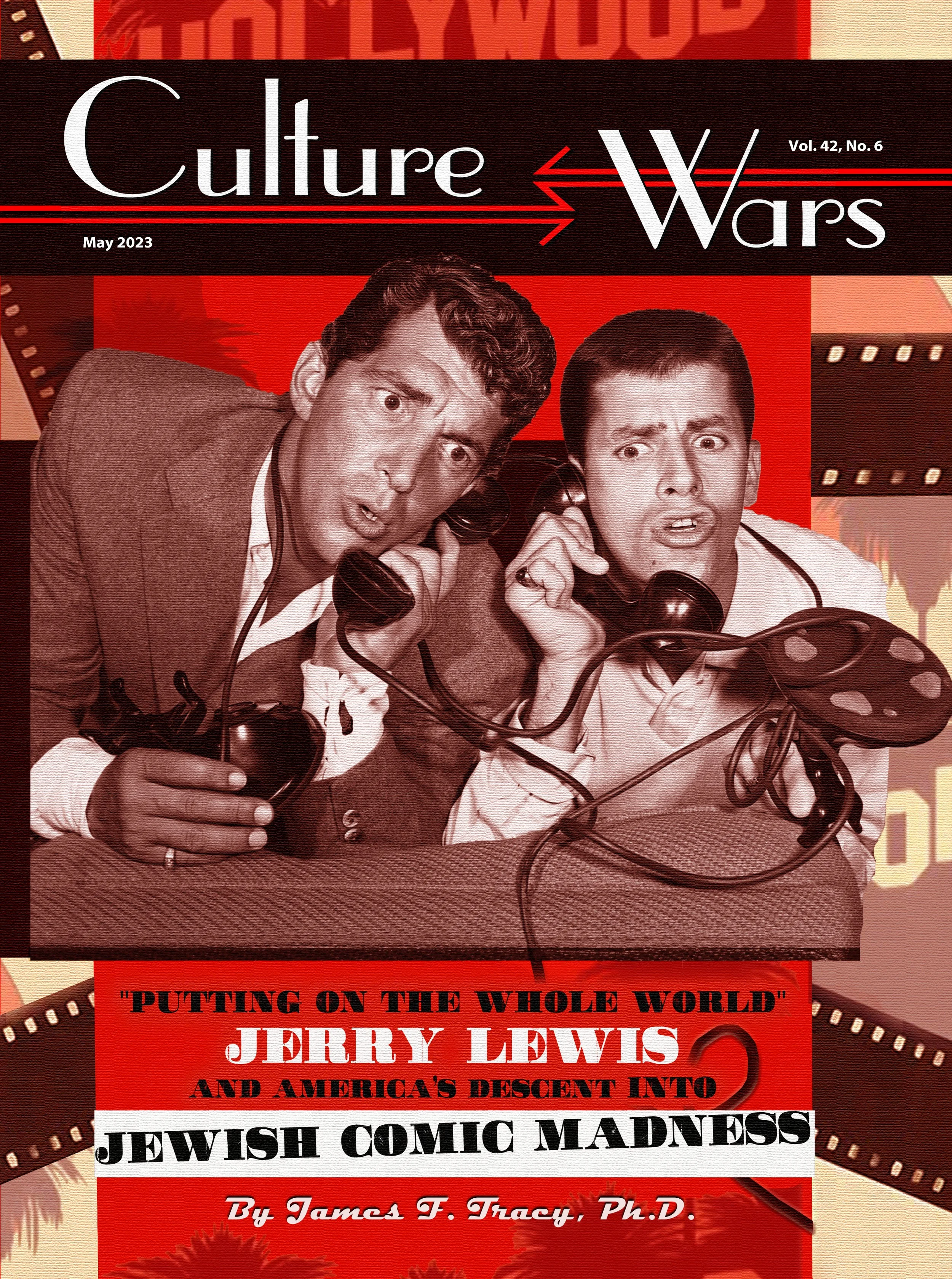

"Putting on the Whole World"

Jerry Lewis and America’s Descent into Jewish Comic Madness

Michigan for Dummies:

How Rainbow Farm Inaugurated Dope Culture in the Wolverine State

Latest Videos:

Watch all our videos on:

Recent Articles:

I’ve never intentionally followed celebrity gossip. I’m more of a Culture Wars reader than a People Magazine reader. However, there has always seemed to be some sort of public discussion around Britney Spears popping up every so often since the late 1990s. Did you hear Britney Spears and Justin Timberlake broke up? Did you hear Britney Spears got married and divorced in Vegas? She got married and divorced again! Did you see the pictures of Britney Spears with her shaved head? Have you seen the “Leave Britney alone” video? Her high-profile conservatorship and the “#FreeBritney” movement came and went. Perhaps with the exception of fortunate homeschooled kids who were protected from mainstream pop culture, most of my fellow Millennials remember these moments…

This all needed a large labor force and waves of immigrants responded. Initially, the workers were mostly German and Irish. But the new arrivals found the stockyard’s working conditions horrid. Attempts were made to organize the laborers. On May 1, 1886, workers at the stockyards joined a nationwide strike for an eight-hour workday…

The change from semitic vengeance to social engineering as the basis for America’s policy during the immediate post war period got imposed on the German people by John J. McCloy, who would also impose social engineering in the form of ethnic cleansing on Catholic ethnic neighborhoods in the United States during the period immediately following his tenure as High Commissioner in Germany. As head of the Ford Foundation in the 1960s, McCloy would employ Black ministers like Leon Sullivan to recruit Black sharecroppers from North and South Carolina to drive Catholics out of ethnic neighborhoods in Philadelphia…

Anyone familiar enough with the Irish psyche, but detached enough to analyze it, will have noticed that much of the antagonism towards Bailey relates to his combination of sex appeal and Englishness. While the murder victim, Sophie Toscan du Plantier, looked like she could have been “one of our own” with her light-ginger hair and pale, freckly skin (it’s easy to picture Saoirse Ronan playing her in a movie adaptation), Bailey ticked all the wrong boxes in an Ireland that still suffers from post-Colonial hang-ups….

In November of 1992, he was advised by telephone that the charges had been dropped, since it was established that he was scientifically correct. Lüftl’s telephone message from the bureaucrat is a notable exception. In the written notification of dismissal, the grounds were not named. In official documents the authorities would always avoid writing down a statement that could have serious consequences, like admitting that revisionists are right after all.

Thinking that his interrogation had ended, Fittkau stood up to leave when the “interpreter suddenly wheeled and pounced on me like an animal catching his prey by surprise. ‘We know you were a member of the Nazi Party. We know you had connections all the time with the SS. They sent you out of Germany with special orders to spy for the Nazi government.’” Thrusting his clenched fist into the air in the Communist salute, Fittkau’s interrogator shouted, “The great Red Army has destroyed Hitler’s swine! Now it will go on to wipe out all priests and all other pigs!”

Now that the history question has been answered without so much as a spoiler alert, and now that Graham Linehan’s particular judgement has been pre-announced, let me urge you to read the book anyway. Tough Crowd is that rare thing, a memoir that will bear repeated readings. Yes, Linehan is just a really good writer, and yes, the book is a captivating blend of social and cultural history that doubles as a series of genuinely expert tutorials: how to write a joke; the golden rules of making a sit-com; casting for sit-coms; how to write a musical; how to keep a writing partnership together…

The rest of the guild prophets fell in line behind John Henry Weston by refusing to give an accurate account of Fiducia Supplicans or the Vatican’s subsequent clarification. Taylor Marshall referred to Fiducia Supplicans as “an example of Francis and Fernandez engaging in Gaslighting.” For those of you who learned English before 2010, gaslighting is “a colloquialism, loosely defined as making someone question their own perception of reality.” The expression, which derives from the title of the 1944 film Gaslight, became popular in the mid-2010s. Merriam-Webster cites “to psychologically manipulate” so that the person questions his own memory, reality, and mental stability. Michael Matt, referring to Fiducia Supplicans as “Fernandez’s new doozy,” ridiculed the claim that FS did not change the Church’s teaching on marriage in the following way “We didn’t change the doctrine on MARRIAGE, remember? Get off our backs.” Followed by “A blessing is not an endorsement. DUH!” The tendentious nature of Matt’s commentary indicates a desire not to persuade or enlighten but to preach to a choir full of people with itching ears, as he has been doing for decades now.

Thus, at Yale I was getting a Jewish education, whether or not I was aware of it. At some point, however, I noticed how many Jewish course offerings there were in the Religious Studies department, and it struck me that they might outnumber the Christian ones. I counted up the courses offered by the department, and found that indeed, Jewish courses outnumbered Christian ones, not including courses like Sarna’s or Metlizki’s, which I had wrongly assumed would be Christian. How odd, I thought, for a school founded by Christian clergymen, in a country where there were reportedly 40 times more Christians than Jews. One of the Christian-themed classes I took in the Religious Studies major was a seminar on Christian monasticism. We took one field trip as part of that class, to the Benedictine Abbey of Regina Laudis in Bethlehem, Connecticut, where we met an elderly nun named Mother Jerome, whom I still remember vividly. She had been born into an aristocratic German family and was living in Munich during World War Two when the city was bombed by British and American planes. Tens of thousands of civilians were killed and wounded, but what she described to us was the aftermath of their bombing the library. Walking out by the river afterwards, she saw thousands of pages of paper flying in the air, caught in tree branches, and falling into the river. I bought a book of her poems, Things That Surround Us.

Paul Johnson tells us that films like Blue Angel were so corrupt that they “could not be shown in Paris. Stage and night club shows in Berlin were the least inhibited of any major capital. Plays, novels and even paintings touched on such themes as homosexuality, sadomasochism, transvestism and incest; and it was in Germany that Freud’s writings were most fully absorbed by the intelligentsia and penetrated the widest range of artistic expression.”[i] Many of these films were labeled “decadent” as soon as Hitler rose to power, and many of the producers fled Germany.

Because of his pathologically histrionic, narcissistic tendencies, Milei resembles the false Jewish messiah Shavetai Zevi, the 17th Century Thessalonian who indulged in sexual orgies before converting to Islam in order to save his life. Milei has openly stated that he practices tantric sex, or sexual yoga, and has also experienced sex in “ménage à trois.” His candidate for governor of the city of Buenos Aires, the usurer Ramiro Marra (from “marrano”) openly declared that he was in favor of the promotion of child pornography by all means…

In the same newsletter, Drake also advertised the already mentioned lecture on “Israel and the Jewish people.” The county commissioners’ meeting was scheduled for 10:00 AM at the county city building, which was roughly a 30-minute drive from the Juday Creek Country Club, where the talk on Israel was scheduled at noon. Amy Drake’s attendance at both meetings shows that it was possible for someone determined to attend both, but it was certainly not convenient since for most of the people in attendance it meant driving from the Republican stronghold of Granger into downtown South Bend and back again…

I have nothing against camels, but as “America’s leading Catholic intellectual,” as Kevin put it, I have a congenital allergic reaction to Unitarianism and more importantly to the Puritanism which spawned the Unitarian reaction by promulgating the distorted notion of Original Sin that goes by the term innate or total depravity. Ever since Ralph Waldo Emerson gave his Harvard Divinity school address, American culture has been plagued by two equally false understandings of Original Sin.

Saying that Voris “brought so many people to the Church by his fidelity” is only slightly less preposterous than saying that his S & M leather bar Church of Nasty expressed “the truths of the faith in a vigorous beautiful way.” Weston’s statement was so out of touch with reality that it demanded an explication of the hidden grammar of his true intentions in making it, but that became clear in light of Weston’s closing statement:

“Let’s pray, and let’s not be taken in. There’s going to be a lot of accusations. There’s going to be an attempt to paint Life Site and Taylor Marshall and Michael Matt with a kind of brush that say’s “Look, look, let’s not go there.”

Whoa, hold on there Jacob! This has nothing to do with resistance? Middle Eastern Muslim militants are really European anti-Semites. Hamas is just another manifestation of Nazism? I honestly don’t know how enflamed with Nazi ideology Hamas really is, but if even Hamas can’t be accorded some justification for dissatisfaction with Israel, then who can be absolved from the charge of being a Nazi sympathizer…

As we have come to expect, whenever Jews need to justify war crimes, ethnic cleansing, or any other act of barbarism, they invoke the Holocaust. After the outbreak of the current war between Israel and Gaza, Ben Shapiro began his call for the extermination of “some of the most demonic evil pieces of human excrement to ever walk the planet,” by saying “This was the worst day for Jews since the Holocaust.” “They are shooting babies,” he continued. “This is what they do.”

But Calvin was hardly an anomaly in this regard. Martin Luther, the founder of the Reformation, repeatedly called himself a prophet. In 1539 he confided to a friend that, “I don’t like prophesying, and I also don’t want to prophesy, because what I prophesy—especially the evil—occurs more than I like… Because I speak God’s word, it has to happen.” In spite of his professed dislike for prophesying, inspired predictions were not at all out of place in Luther’s daily life. In January 1532, Luther “foretold that he would be sick, that in March he would be overtaken by a grave illness.”

Both the German Lutheran Jew Marx and the Russian Jew Alinsky fit the mold described in Civilta Cattolica by Fr. Giuseppe Oreglia di Santo Stefano who, like Christ, explained that those who reject Him become the children of Satan: many Jews possessed by “Satan, by demons or by spirits, that is, moved by a satanic hatred of the Christian name” have “always persecuted the Christians” and not the other way around.

Catcher in the Rye is a dreadfully banal and blasphemous book that forces the reader inside the head of a teenage loser as he descends lower into popular culture oblivion. We might even say that the book has shaped or even defined pop culture and popularity itself. Holden Caulfield was a popular person at his prep school in every modern way – i.e., he smoked, he drank, he cursed, he used Christ’s name in vain fluently, he mingled comfortably with alpha males and attractive girls, he had wealthy, indifferent parents and a suave older brother…

hen Buttigieg mentioned that the Ford F-150 Lightning and the Chevy Silverado EV both start at under $40k. He was right about the Ford at the time he made that remark, but the 2023 Ford F-150 Lightning starts at just under $50k (it flirts with $100k when fully loaded), and the Chevy Silverado EV still isn’t on the market. Mayor Pete quoted the price of a truck that didn’t exist yet and still isn’t available to buy a year later. If you go to Chevy’s website, you won’t even find an estimated price for the Silverado EV, raising doubt about a starting price anywhere near $40k.

On June 27, a local branch of the Proud Boys showed up at what was supposed to be a Drag Queen Story Hour at the Virginia M. Tutt branch of the St. Joseph County Public Library. WVPE, the local NPR affiliate, gave a tendentious account of the incident which incorporated all of the usual epithets about “the growth of hateful right-wing rhetoric against LGBTQ people” at the hands of the Proud Boys “and other far-right groups” which “have turned up at Pride parades and events like drag queen story hours.”

The Jews rejected the fundamental basis of the universe when they rejected the Messiah because as St. John writes about the Son of God at the beginning of the fourth Gospel, “In the beginning was the Logos, and the Logos was with God, and the Logos was God.” In rejecting the Second Person of the Trinity, the Jews reject order and redemption. The Jews reject their Messiah and turn instead to anti-Christian revolutionary movements. If Logos is indeed the fundamental basis of the universe, then the logos of practical reason known as morality should determine human behavior. This truth was lost on the Jews who ran the Manhattan Project, because the Jewish revolutionary spirit, manifested as Communism at the time, was in fundamental rebellion against the order of the universe that Werner Heisenberg discovered by reading Greek to determine whether to create an atomic bomb.

Then sensing that an even more radical form of damage control was necessary, Gould asked for unanimous support from parliament to expunge the embarrassing incident permanently from the official record, prompting me to tweet “Nazi Gate goes down the memory hole. Has MP Karina (“As a descendent of Jewish Holocaust survivors”) Gould been reading George Orwell? Does she think pretending that the standing ovation for the Nazi never happened will blot it from everyone’s memory?”

The main vehicle for the Oppenheimers’ assimilation into American culture was the Ethical Culture Society, a “non-religion” which was founded in 1876 by Felix Adler as an outgrowth of American Reform Judaism. Adler’s “non-religion,” according to Bird, would “have a powerful influence in the molding of Robert Oppenheimer’s psyche, both emotionally and intellectually.”

So, the Passion and Death of Jesus Christ at the hands of the Jews comes down to a difference of opinion on how to “renew the Jewish people in their relationship with God.” The Pharisees felt that it was better for one man to die than for the people to perish, and who are we to say that killing Christ wasn’t seen as a good thing in their eyes? And if the testimony of John’s Gospel on the Pharisees is inaccurate, why should we believe John’s claim that Christ rose from the dead after John and St. Peter contemplated the empty tomb? Didn’t the Pharisees come up with a much more plausible explanation when they claimed that Jesus’s followers stole His body?

Most of the poems with gloomy references to God or Christ are found in Borges later books, while most of his poems with positive allusions are found in his early work. This seems to indicate a trajectory and does not bode well for Borges because, as Alexander Solzhenitsyn and E.M. Jones have pointed out time and again, what is in the soul of an artist will be bared, explicitly or implicitly, in his work.

In May of 2023, the Biden Administration released the first U.S. National Strategy to Counter Antisemitism, a document which President Biden claimed “represents the most ambitious and comprehensive U.S. government-led effort to fight antisemitism in American history.” The historical significance of this document diminished considerably in light of the legal disclaimer which preceded its content.

I interviewed her in 2011 and immediately realized that she was vulnerable. I was writing a humorous piece about her fake search for Mr. Right at a corny Irish matchmaking festival so it wasn’t an in-depth interview, but I noticed that she was unable to set boundaries when men approached her. I was careful in the resulting article not to make her look like a fool, and the photographer working with me was equally aware of the need to treat her gently.

I’ve never intentionally followed celebrity gossip. I’m more of a Culture Wars reader than a People Magazine reader. However, there has always seemed to be some sort of public discussion around Britney Spears popping up every so often since the late 1990s. Did you hear Britney Spears and Justin Timberlake broke up? Did you hear Britney Spears got married and divorced in Vegas? She got married and divorced again! Did you see the pictures of Britney Spears with her shaved head? Have you seen the “Leave Britney alone” video? Her high-profile conservatorship and the “#FreeBritney” movement came and went. Perhaps with the exception of fortunate homeschooled kids who were protected from mainstream pop culture, most of my fellow Millennials remember these moments…